A globally spread market

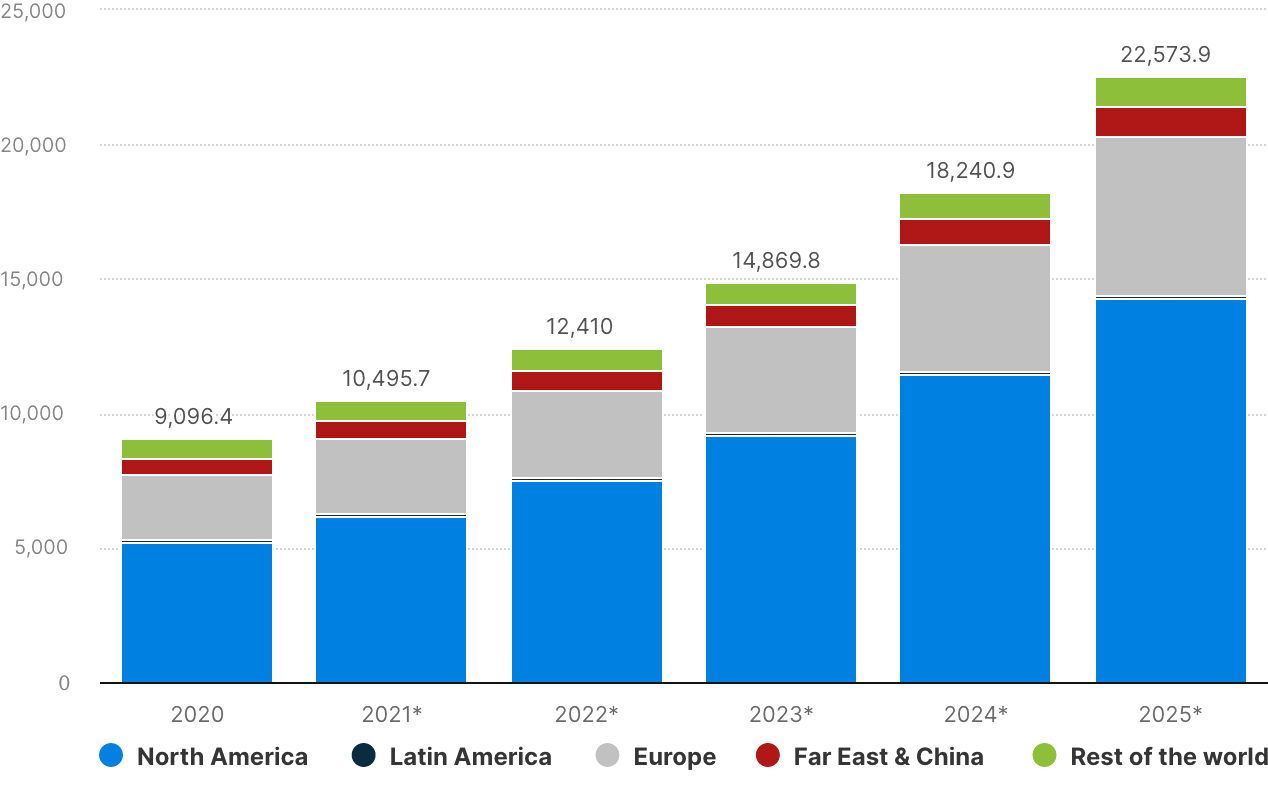

Looking at the market size overview of the industry shows skyrocketing growth. As calculated by the Statista and Juniper Research survey, the sector has an estimated value of $10 billion to $12 billion; the forecasts for 2025 predict an increase to $22.5 billion, with an astounding growth rate of more than 104 percent. An geographical analysis is also revealing: the largest hub of agricultural innovation is the North American market. In 2021 almost half of the value of the AgTech market ($6.2 billion) was located in the U.S. or in the Canadian market. The remaining capital was split between Europe ($2.7 billion), the rest of the world ($708.8 million), the Far East and China ($665 million) and Latin America ($41.7 million).

Around the world in six start-ups

We took a look at a number of start-ups that are making an impact in various areas of the world.

AgTechs often respond to problems specific to the area where they were born, determined by geopolitical, environmental or economic factors. The graph below by Statista shows that the United States holds by far the highets market values in the AgTech industry, followed by the European block, the far east and China and Latin America.

AgTech market value 2020/2025

Image Credits: Statista and Juniper Reasearch Survey

North America: mRNA to boost crop resilience – GreenLight BioSciences

Messenger RNA (mRNA) is a genetic technology that first became known with during the Covid-19 pandemic: the company started working on making effective vaccines. However, it also has interesting applications in the agronomic field. In particular, it can have medicinal uses for crops, preserving them from pesticides and thus limiting the use of chemical agents and maximizing productivity. That is precisely the specialty of GreenLight BioSciences. The Medford, Massachusetts-based startup is one of the most promising. Founded in 2008, it's finally gaining momentum and establishing itself as one of the companies with the steepest growth curve. In fact, the forecast for the next 5 years predicts an expansion of 516%.

Europe: an “air-laboratory” to unlock the power of data – Stenon GmbH

In an increasingly data-driven agricultural sector, the collection of clear and actionable data is a crucial process; however, this requires large lab facilities and complex analysis. In fact, soil sampling is costly and time consuming; Stenon GmbH, a German start-up based in Potsdam, just outside the capital Berlin, makes it faster and cheaper, providing farmers with a system of tools and sensor to process data and samples independently, freeing them from the need of a professional laboratory.

East Asia: smart agriculture comes flying in - XAG

"Advancing Agriculture" is XAG's leading principle for many years, the company was already founded in 2007, developing drones, in 2014 it started to focus on drones for agriculture only recently it has started to experience rapid growth, thanks in part to a funding round of $228 million by the Chinese government. The company core business is focused on innovation for agriculture: engineering and production of drones for planting and irrigation, IoT systems for crop monitoring and data production.

A drone monitoring crops.

South America: innovation means credits access – Agrolend

With 80.017.000 hectares of land, Brazil holds immense opportunity to produce and to empower its population and this is precisely Agrolend’s mission. The agrofintech start-up aims to create a credit access network for small and medium-sized agricultural enterprises, enabling farmers to support investments in an affordable, digital and low-interest basis. In January 2022, Agrolend secured a $15 million A Series funding round.

The rest of the world: from the Middle East to Subsaharan Africa

AgTech startups are thriving even outside the areas indicated by Statista's report. In the EMEA area the Israeli market stands out, for example, MetoMotion is a promising start-up. Founded in 2016 it counts on a capitalization of more than $10 million and offers robotic interfaces for agriculture. MetoMotion's most famous project is GRoW: a robotic unit capable of autonomously harvesting fruits and vegetables on production sites. GRoW can cut processing time by 80 percent and take over labour intensive tasks carried out in greenhouse, solving one of the problems that plagues farmers the most: labour shortages.

Finally, in Africa, where a large part of the workforce is employed in agriculture, there is a remarkable expansion of startups that aim to innovate to support local farmers. One of the most promising is ReLeaf: founded in 2017 in Uyo, Nigeria, it has already attracted more than $4 million in funding. ReLeaf has a goal: to streamline the productivity of African agricultural enterprises through a synergy of subsidized credit services and technology.

Ensuring impactful change for the food system

It is clear that the AgTech industry is attracting capital worldwide. Technology is spurring rapid growth in many sectors and it has high potential for the Ag sector for increasing efficiency, productivity and empowering individuals in developing countries. The challenge that the world faces concerning food security and environmental protection call for innovative and bold solutions, however, it is also important to ensure that new technologies are also successful in delivering real impact with tangible benefits for the whole food system and agriculture's sustainability.

What is SoilHive?

Discover more about our other service SoilHive and how it can revolutionize collaboration in the Food & Ag industry and enhance soil data accessibility. Explore more at: